Encouraging Business Owners: Leveraging Difficult Money Fundings for Organization Development

Tough cash loans have emerged as a viable choice for entrepreneurs looking to utilize outside financing to drive their organizations ahead. By discovering the subtleties of difficult money finances and their implications for business expansion, entrepreneurs can obtain beneficial insights right into exactly how this different financing method can be the stimulant for their next phase of development.

Comprehending Hard Cash Lendings

Difficult cash fundings are a form of financing typically secured by the value of a residential property, supplying a quicker and a lot more flexible option for debtors with certain funding requirements. hard money loans in ga. Unlike typical small business loan, hard cash fundings are usually used by personal capitalists or companies and are based upon the security value of the building instead of the debtor's creditworthiness. This makes tough money financings optimal for individuals or organizations that may not get approved for conventional loans as a result of credit issues, revenue confirmation troubles, or the demand for a rapid funding process

The application process for tough cash car loans is generally much faster and much less rigorous than standard car loans, making them an eye-catching choice for debtors seeking to safeguard financing rapidly. While conventional financings might take weeks or perhaps months to authorize, difficult money car loans can frequently be processed in an issue of days. Furthermore, difficult cash loan providers are a lot more ready to collaborate with debtors on a case-by-case basis, permitting more customized and versatile terms to meet the borrower's details requirements.

Advantages for Business Growth

Leveraging difficult money financings can offer substantial benefits for business owners seeking quick company development through different funding solutions. One crucial benefit is the speed at which difficult money finances can be secured contrasted to typical small business loan. This fast access to funding permits business owners to take advantage of time-sensitive possibilities, such as buying supply at a reduced price or investing in new equipment to increase manufacturing ability.

Furthermore, hard cash financings are asset-based, indicating that the car loan authorization is mainly based upon the value of the security as opposed to the borrower's credit scores rating. This element makes difficult cash finances extra easily accessible to entrepreneurs with less-than-perfect credit report, enabling them to obtain the needed funding to expand their organizations.

Eligibility and Application Refine

When taking into consideration difficult money lendings for service development, comprehending the eligibility demands and application procedure is important for business owners looking for choice funding choices. Lenders using difficult cash fundings are mainly worried with the residential property's potential to create returns and the consumer's ability to pay off the financing. The application procedure for difficult money finances is frequently quicker than traditional financial institution car loans, with choices being made based on the property's worth and possible profitability of the company growth.

Leveraging Difficult Money for Growth

Understanding the strategic usage of different funding mechanisms like difficult money loans can considerably strengthen company see this page growth efforts for business owners. By accessing difficult cash car loans, business owners can safeguard financing swiftly without the extensive documents and approval processes generally linked with traditional car loans.

In addition, tough money lendings supply flexibility in regards to collateral needs, making them accessible to business owners that may not have considerable assets or a strong credit rating. This element is especially useful for services looking to expand quickly or those running in industries with fluctuating money flows. Additionally, the temporary nature of difficult cash car loans can be valuable for business owners seeking to money this hyperlink certain growth tasks without dedicating to long-term debt commitments. Generally, leveraging difficult money for expansion offers entrepreneurs with a visit this site functional funding tool to sustain their growth ambitions effectively and properly.

Dangers and Factors To Consider

Mindful analysis of potential threats and considerations is paramount when discovering the application of difficult money financings for business expansion. Unlike conventional financial institution finances, hard money lendings normally come with considerably higher interest rates, which can boost the overall price of loaning and influence the earnings of the company.

Verdict

Finally, tough cash finances supply entrepreneurs a sensible alternative for business development. With their quick authorization process and flexible terms, these finances provide a chance for development and advancement. Entrepreneurs must very carefully take into consideration the risks included, such as greater interest rates and possible security requirements. By leveraging tough cash loans efficiently, business owners can equip their companies to reach brand-new elevations and attain their expansion goals.

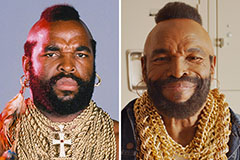

Mr. T Then & Now!

Mr. T Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!